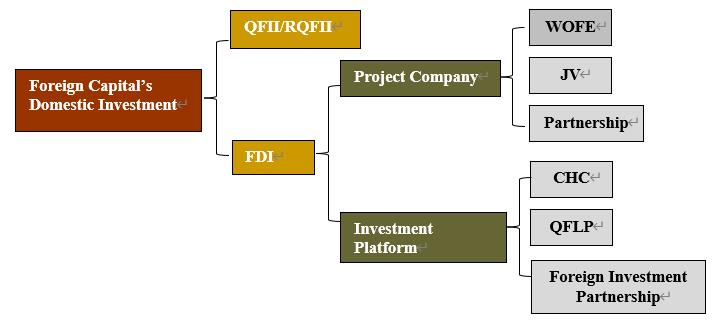

Comparison of methods of foreign capital participation in domestic investment - FDI/QFII/RQFII/QDLP......

In recent years, with the rapid development of China's economy and the deepening of its openness to the outside world, the enthusiasm of foreign capital to enter domestic investment has increased significantly, and there are more and more ways to legally enter the country.

(1) What is QFII/RQFII?

QFII is Qualified foreign institutional investor.

The QFII system, refers to a capital market opening method in which foreign institutional investors exchange foreign currency for RMB to invest in the domestic securities market and can convert capital gains and dividends into foreign currency for remittance after approval by China Securities Regulatory Committee.

RQFII is RMB qualified foreign institutional investor.

The RQFII system is an innovation from the QFII system, which is for foreign institutions to invest in the domestic securities market in RMB. The main difference between RQFII and QFII is the different currency used.

Note: From 2019, both the individual quota and the total quota limit for QFII/RQFII are removed.

(2) What is FDI?

FDI means foreign direct investment. According to the Foreign Investment Law that came into force in January 1, 2020 and related laws and regulations, FDI is the direct investment in China by foreign enterprises and economic organizations or individuals (including overseas Chinese, compatriots from Hong Kong, Macao and Taiwan, as well as Chinese enterprises registered outside China) with cash, in-kind, technology, etc. in accordance with relevant policies, laws and regulations of China.

FDI includes setting up investment projects in China (including wholly foreign-owned enterprises), setting up joint ventures with enterprises or economic organizations in China, investment in co-operative ventures or in the development of co-operative resources (including reinvestment of foreign investment proceeds), as well as funds borrowed by enterprises from abroad within the total investment amount of the project approved by the relevant government departments.

(3) What are the main differences between FDI and QFII/RQFII?

a. The investment areas are different.

FDI: domestic equity investment, commonly known as primary market, and subject to the negative list of foreign investment.

QFII/RQFII: domestic securities and futures investment, commonly known as secondary market.

b. Different investment subjects.

FDI: all foreign natural persons, enterprises or other organizations.

QFII/RQFII: Institutions recognized by the China Securities Regulatory Commission, generally including overseas fund management companies, commercial banks, insurance companies, securities companies, futures companies, trust companies, government investment institutions, sovereign funds, pension funds, charitable funds, endowments, international organizations, etc.

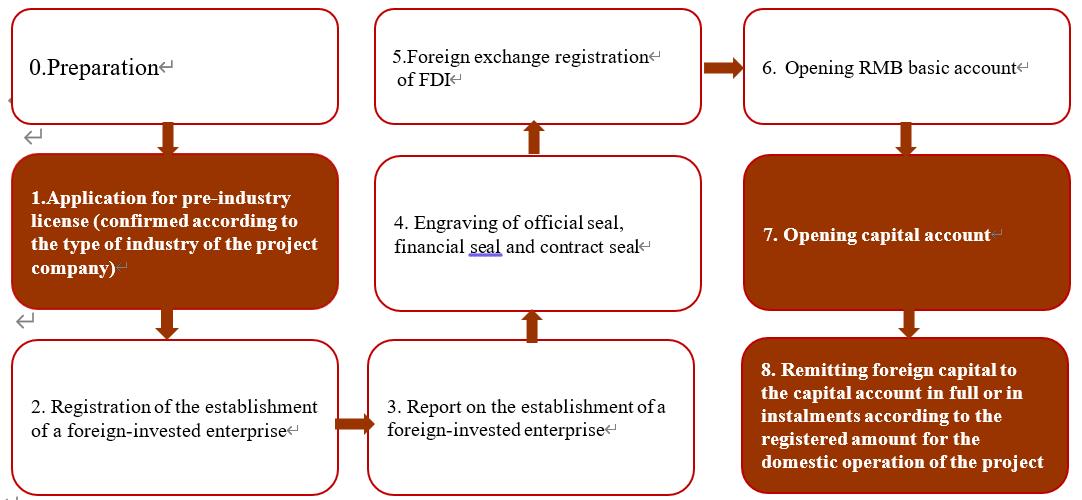

(4)How do foreign funds enter the country under the WFOE/JV/foreign partnership route?

The investment entity prepares the application documents and then proceeds to register in the following order.

Application for pre-industry license (if involved)

Registration of the establishment of a foreign-invested enterprise

Report on the establishment of a foreign-invested enterprise

Engraving of official seal, financial seal and contract seal

Foreign exchange registration of FDI

Opening RMB basic account and capital account

Afterwards, the foreign capital can be remitted to the capital account in full or in instalments according to the registered amount for the domestic operation of the project company.

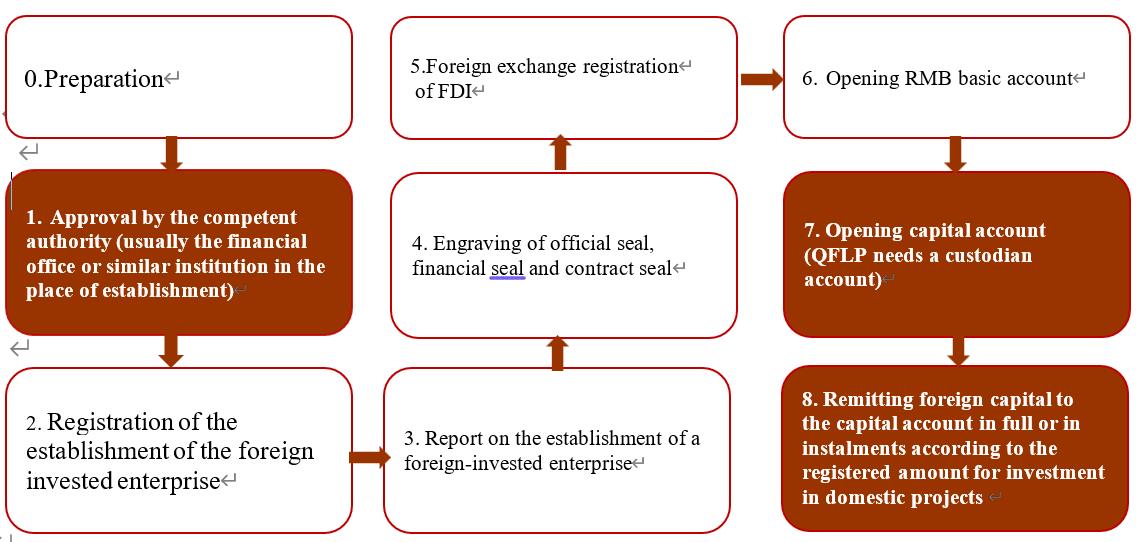

(5)How to enter foreign funds through the CHC, QFLP and foreign investment partnership routes?

The investment entity prepares the application documents and then proceeds to register in the following order.

Approval by the competent authority (usually the financial office or similar institution in the place of establishment)

Registration of the establishment of the foreign-invested enterprise

Report on the establishment of the foreign-invested enterprise

Engraving of official seal, financial seal and contract seal

Foreign exchange registration of FDI

Opening RMB basic account and capital account (QFLP needs a custodian account)

Afterwards, the foreign capital can be remitted to the capital account in full or in instalments according to the registered amount for investment in domestic projects.

(6) What is the difference between CHC, QFLP and foreign-invested partnership?

(1) CHC has high qualification requirements for investment entities, all projects outside the negative list can be invested in. QFLP has high qualification requirements for investment entities, high qualification requirements for management personnel. GP must have completed the fund manager filing. Some QFLP pilot areas require that QFLP fund managers and funds must be registered locally. QFLP also needs to complete the GP's local establishment and fund manager filing before establishment. Foreign-invested partnership has lower qualification requirements for investment entities and no fund manager qualification requirements for GPs.

(2) QFLPs are required to file for private equity funds in accordance with the requirements of the China Securities Investment Fund Association after their establishment, while CHCs and foreign-invested partnerships are not required to do so.

(3) QFLPs are required to use overseas funds under custodial management, while CHCs and foreign-invested partnerships are not required to do so.

What are the main differences, advantages and disadvantages of FDI project companies (WFOE/JV/foreign partnerships) and FDI platform companies (CHC, QFLP, foreign investment partnerships)?

(1) Different modes of operation

For project company (WFOE/JV/foreign partnership), foreign capital is invested directly into each project company, with each project applying for separate quotas.

Project companies take different organizational forms depending on the specific circumstances of the project operation, including WFOE/JV/foreign equity partnerships.

For platform companies (CHC, QFLP, foreign-invested partnerships), foreign capital is first pooled into a domestic platform company and then invested in a number of project companies.

The platform company applies for a one-off estimated total amount at the time of establishment and does not need to apply for approval for a number of projects.

Once the platform company is established and has completed the foreign exchange registration and capital account opening, it only needs to issue instructions to the bank and proceed directly with the bank to settle the foreign exchange and transfer the funds.

Platform companies take different organizational forms according to different situations, including CHC, QFLP and foreign investment partnership.

(2)Different difficulties in landing

Platform companies (CHCs, QFLPs and foreign investment partnerships) are more difficult to land in China, except for CHCs. QFLPs can only land in pilot cities/regions, and the landing of foreign investment partnerships depends on the liberalization of local policies for investment enterprises. The actual implementation of CHC is not easy due to the high qualification requirements for investment entities and the openness of the landing area to investment enterprises.

On the contrary, project companies (WFOE/JV/foreign partnerships) that comply with the national industrial policy can basically be landed in the country.

(3) Different convenience of foreign exchange settlement

As shown in point (1) of this article, under the project company model, each investment in a project needs to be approved in accordance with the process in Article 4 and the funds obtained will only be used for the operation of the project company, whereas CHCs, QFLPs and foreign investment partnerships shall apply for a landing platform and the total amount to be invested in the country at one time. The funds can be allocated directly to the project company in the country upon confirmation of subsequent investment projects.

(4) Different taxation and preferential policies

Project companies (WFOE/JV/foreign partnerships) invested by foreign capital can enjoy tax incentives for high-tech enterprises, general foreign-invested enterprises income tax incentives, or case-by-case incentives negotiated with the government where the project is located, etc. if they meet the conditions.

Among the platform companies (CHCs, QFLPs and foreign investment partnerships), QFLP funds are only taxable when profits are distributed to GPs/LPs. QFLPs can usually set up multiple project companies and file a unified tax return to offset profits and losses between projects.

Most QFLP pilot cities/regions offer tax incentives to QFLPs. For example, Article 22 of the Interim Measures of Hainan Province on Domestic Equity Investment by Qualified Foreign Limited Partnerships (QFLPs) states: "Actively promote the inclusion of foreign-invested equity investment enterprises in the directory of industries encouraged by Hainan Free Trade Port and the directory of industries encouraged by foreign investment, and enjoy enterprise income tax preferences. Foreign-invested equity-invested enterprises settled in key industrial parks may enjoy the local preferential policies of the key industrial parks where they are settled." In addition, according to the Notice on Preferential Policies on Enterprise Income Tax for Hainan Free Trade Port and the Notice on Policies on Personal Income Tax for High-end and Shortage Talents in Hainan Free Trade Port, enterprises in encouraged industries registered and substantially operating in Hainan Free Trade Port are subject to a reduced corporate income tax rate of 15%. High-end and scarce talents working in Hainan's free trade port will be exempted from the portion of their personal income tax that exceeds 15% of their actual tax liability. Guangzhou's QFLP policy is applicable to venture capital enterprises or venture capital funds.

CHCs can also enjoy preferential policies for headquarter enterprises if they meet the relevant recognition criteria for landing local headquarter enterprises. Beijing, Shanghai and Tianjin have all introduced recognition criteria and preferential policy management measures.

Conclusion

To sum up, when investing abroad, investors and project parties need to consider the qualification of the investment body, the investment field, the investment path, tax incentives and time costs in order to choose the appropriate approach.

We will continue to monitor the business development and policies regarding cross-border capital flows, provide professional services to investors and market institutions, and escort capital flows.